Make the best senior care decision

Does Medicaid Pay for Assisted Living?

For many seniors, seeking assisted living is a decision of both the conscience and the heart. On the one hand, seniors may choose to move into assisted living communities so they don’t have to lean on family for support with health issues or with activities of daily living, and, on the other, they see that assisted living can make it easier to maintain a healthy lifestyle, enjoy social opportunities, and engage in meaningful activities. It’s no secret that assisted living costs can stretch any family budget — the median cost for assisted living in 2021 was $4,500 per month.{{citation:1}}{{citation:2}} However, Medicaid may help take the edge off some of the costs associated with this type of care.

Key Takeaways

- Medicaid is government-sponsored health insurance for low-income families and seniors. Benefits and eligibility vary as states have the flexibility to design and administer their own programs.

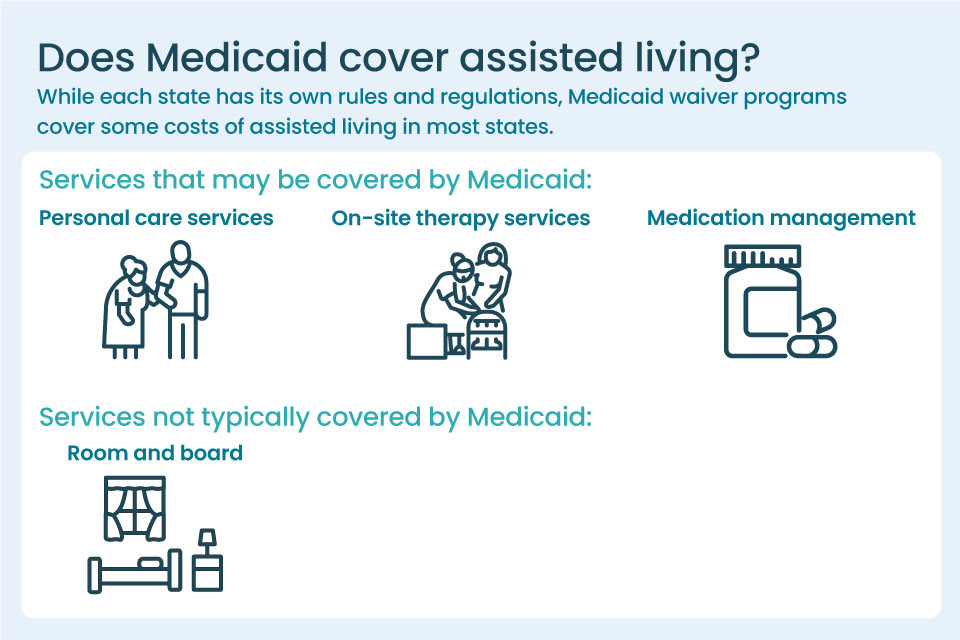

- Medicaid covers some costs of assisted living in most states. Room and board are not covered by Medicaid, but it does often pay for several care services, including support with activities of daily living.

- Medicaid waiver programs offer states the flexibility to expand care for certain groups of people. Many waiver programs encourage seniors to age at home by providing coverage for home care services.

- There may be alternatives to assisted living that are covered by Medicaid. Combining a variety of community- and home-based care options may be a great way to create a care plan for your loved one.

In this Article

Medicaid: government health care assistance for low-income seniors

Enacted in 1965, Medicaid is the leading government assistance program for health care coverage. Medicaid is essentially a health insurance safety net for Americans who can’t afford the care they need on their own. A cooperative effort between the federal government and individual states, the federal government provides the majority of the program’s funding.

Also, it’s important to know that Medicaid is commonly used as a generic term to describe a number of different programs. However, industry professionals use the term to refer to a specific program that pays for medical care, similar to traditional health insurance.

How to apply for Medicaid

In order to qualify for Medicaid, a person must meet several requirements:

- Their income must fall below a state’s Medicaid income limit, or their medical-related care expenses must exceed their income.

- Their countable assets must fall within acceptable ranges.

- They must reside in the state where they wish to receive benefits.

- They must be a permanent resident of the United States or have U.S. citizenship.

- They must have the requisite medical need.[03]

Each state has its own application guidelines, so it’s important to contact your state’s medical assistance office for more details. Or, you can contact an elder law attorney who can walk you through the nuances of eligibility for benefits and the Medicaid application process.

What assisted living costs does Medicaid cover?

Medicaid acts as health insurance that covers nearly every type of health care cost, including some long-term care costs. While each state has its own rules and regulations, Medicaid waiver programs cover some costs of assisted living in most states. It’s important to note that Medicaid generally does not cover room and board but may include various care services:

- Long-term care provided by assisted living communities and residential care homes

- Inpatient and outpatient hospital services not covered by Medicare

- Home health services

- Prescription drugs

- Physical, occupational, or speech therapy

- Eyeglasses and hearing aids

- Personal care services

- Hospice care

- Co-pays for hospitalization and skilled nursing care not covered by Medicare

Let our care assessment guide you

Our free tool provides options, advice, and next steps based on your unique situation.

What assisted living facilities accept Medicaid?

If you’re looking for Medicaid-certified assisted living communities, first review information online about Medicaid waiver programs available in your state. Waivers enable states to work around certain rules in federal Medicaid laws. The use of waivers gives individual states flexibility toward specific objectives that they’re aiming to achieve, like improving or expanding care for certain groups of people and reducing costs.

Home and Community-Based Services (HCBS) is an example of a waiver program that provides specific options for Medicaid beneficiaries.[04] Each state can create individual HCBS waivers to support the needs of specific groups, allowing qualified individuals to receive care services in their home or community as opposed to an institutional setting.

You can also contact your local Medicaid office, Department of Aging, Department of Elder Affairs, or social service agency for assistance with understanding your care options. Be sure to request a list of all Medicaid programs in your state that you or your loved one may be eligible for.

Here are some other questions to keep in mind when speaking with an agent:

- What is the process for applying for Medicaid?

- Are there social workers or case workers available to assist with the application process?

- Is there a waiting list? If so, how long is it? Are they currently adding individuals to the list?

- What are the income and asset qualifications for Medicaid waiver programs?

- Are there any programs that provide services in the home?

- Is there a state-funded assisted living program?

Talk with a Senior Living Advisor

Our advisors help 300,000 families each year find the right senior care for their loved ones.

How much will Medicaid pay for assisted living?

The specific amount that Medicaid will pay for assisted living varies for each person. Certain states may impose copayments, coinsurance, deductibles, and other similar charges for non-emergency services based on an individual’s income.[05]

Medicaid waivers can help contribute to the cost of care in an assisted living facility. For eligibility, individuals must demonstrate that care is needed, in addition to proving that either their income falls below a certain level or that the cost of care they require exceeds their income. This may allow them to qualify for limited Medicaid benefits through a medically needy or income spend-down program, in 36 states and the District of Columbia.

And, while Medicaid offers numerous options to help cover assisted living costs, many families still find themselves having to seek additional resources.

Other ways to supplement assisted living costs

Unlike Medicaid, Medicare will not cover services provided in an assisted living facility. However, Medicare, which provides federal health insurance coverage to most people 65+ can be helpful for covering medical costs, regardless of where a senior lives.

Families may find it necessary to rely on personal sources such as retirement savings or long-term care insurance. And some insurance companies will allow customers to use a life insurance policy to pay for long-term care. However, these particular assets typically disqualify an individual from Medicaid eligibility.

For support with tasks like shopping, transportation, budgeting, or legal issues, there may be organizations or volunteer groups in your community that offer help for a small fee or perhaps even free of charge. Meal programs, companionship programs, and senior centers may also be available to provide additional support when Medicaid does not.

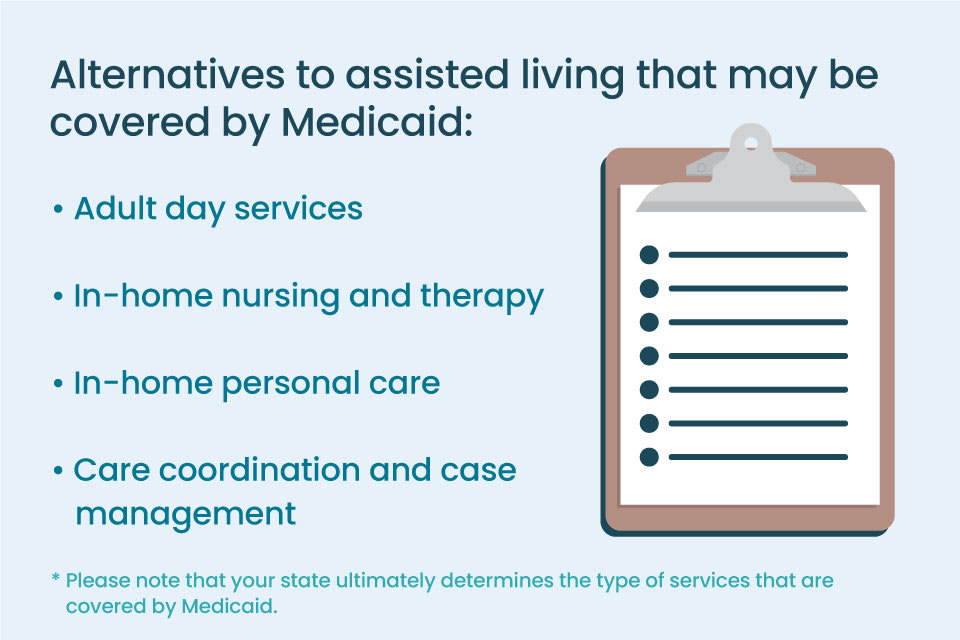

Alternatives to assisted living that may be covered by Medicaid

Finding the best care arrangement for a loved one can be a stressful process. While an assisted living community can offer care services and peace of mind, there may also be other helpful options. Your state ultimately determines the type of services that are covered by Medicaid, but some alternatives to assisted living may be available to you:

- Adult day services

- In-home nursing and therapy

- Care coordination and case management

- In-home care, which may include help with cooking, cleaning, or other daily activities

If you or your loved one are currently in a skilled nursing facility under Medicaid, one payment assistance option is the Medicaid program called Money Follows the Person.[07] It provides states with federal funding to help seniors move out of facilities like nursing homes and back into their own homes or other living arrangements in their community.

The Program of All-Inclusive Care for the Elderly (PACE) is another community-based Medicaid offering that provides both medical and social services to eligible seniors.[08] PACE is designed to deliver coordinated care through an interdisciplinary team of health professionals who are assigned to PACE participants. The program provides an alternative to nursing homes and allows many seniors to receive care in their own homes.

While the costs of assisted living continue to increase, there are a number of resources to help low-income seniors pay for care. For those who have additional questions or need guidance searching for assisted living options, a Senior Living Advisor at A Place for Mom can provide information to help you find the communities that best fit your family’s financial and care needs.

Genworth. (2021, November). Cost of care survey.

A Place for Mom. (2022). A Place for Mom proprietary senior living price index.

Centers for Medicaid & Medicare Services. Eligibility.

Centers for Medicare & Medicaid Services. Home and community based services.

Centers for Medicare & Medicaid Services. Cost sharing out of pocket costs.

Centers for Medicare & Medicaid Services. Your guide to choosing a nursing home or other long‑term services and supports.

Centers for Medicare & Medicaid Services. Money follows the person.

Centers for Medicare & Medicaid Services. Program of all-inclusive care for the elderly.

The information contained in this article is for informational purposes only and is not intended to constitute medical, legal or financial advice or create a professional relationship between A Place for Mom and the reader. Always seek the advice of your health care provider, attorney or financial advisor with respect to any particular matter and do not act or refrain from acting on the basis of anything you have read on this site. Links to third-party websites are only for the convenience of the reader; A Place for Mom does not recommend or endorse the contents of the third-party sites.